Over the past two weeks, United Nations member countries started substantive negotiations for the first-ever UN Framework Convention on International Tax Cooperation; a historic process that reflects major shifts in global economic policymaking and geopolitics. The treaty could replace the current patchwork system that deprives governments of considerable revenue and undermines their capacity to support human rights.

The treaty’s terms of reference, adopted by the UN General Assembly last August, establishes a framework convention and two protocols, focuses on cross-border services and on dispute prevention and resolution.

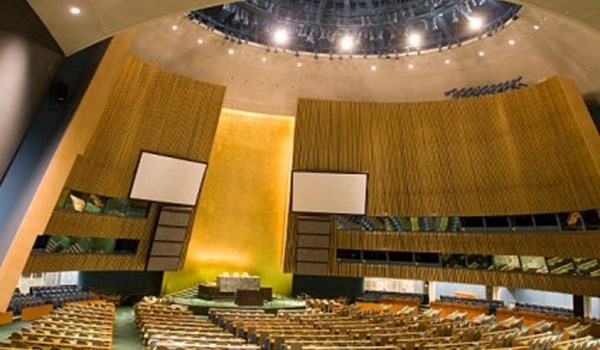

That governments around the world are debating tax challenges in the UN General Assembly, where each country has one vote, itself marks a shift towards fairer representation in international economic decision-making. The United States withdrew during the first round of negotiations in February 2025 and expressed its intention to reject the outcomes of the process. But dozens of other governments, including European Union members and others initially skeptical about the treaty, worked to find common ground during this first of eight negotiation sessions. The draft treaty will be submitted for adoption in 2027, during the UN General Assembly’s 87th session.

The convention and protocols should reach agreement among countries on how to fairly share taxing rights, the authority to impose taxes on income, assets, and economic activities, in a world where corporations commonly operate across borders. While governments had a range of views, there was “significant agreement,” as UN Under-Secretary-General for Economic and Social Affairs Li Junhua noted, that “current international tax rules do not deal adequately with new business models.”

Member states appeared keen to change rules that give governments taxing rights only when companies have a physical presence in their country, which doesn’t reflect today’s globalized and digitized economic reality. Proposed reforms, such as enabling governments to tax any company with a “significant economic presence” in their territory, could generate new revenues for all countries, which is especially critical to help developing countries close financing gaps for health care, education, social security, and other rights.

In a world of extreme inequality, mounting economic pressures on governments, and a fractured multilateral system, the negotiations for a UN tax treaty offer a ray of hope. When governments are willing to come together, it is possible to find potential avenues for advancing shared interests, including tax reforms that better align with human rights.