The European Green Bond Standard (EUGBS), a landmark regulatory framework for sustainable bonds, will take effect on 21 December 2024. Issuers may then use the “European green bond” or “EuGB” designation for their bond issuances.

EuGB issuances worth hundreds of billions of euros could be on the way from various issuer types such as supranational entities, government agencies, sovereigns, financial institutions and corporates, forming a prominent subset of the green bond market. This will also improve overall market credibility.

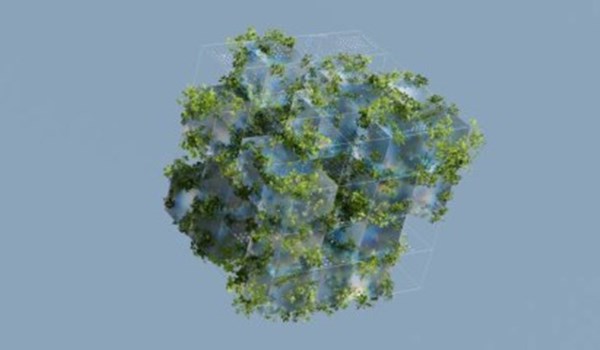

EuGB issuance is a natural home for funding European Union (EU) taxonomy-aligned investments: The standard requires use of proceeds to be aligned with the EU taxonomy, which defines “environmentally sustainable” activities in sectors such as energy, transport, building and manufacturing. These investments are expected to grow over time to support climate objectives, creating an increasingly significant candidate pool for EuGB issuances.