US: US government enshrines renewables tax credits

The US Department of the Treasury and the Internal Revenue Service have moved to enshrine certain tax credits under President Joe Biden’s Inflation Reduction Act (IRA) into the American tax code

A new proposal is underway in the United States which aims to establish the country as a global leader in the digital economy through the creation of a Bitcoin tax-free Digital Economic Zone (DEZ).

The initiative, spearheaded by the newly formed USABTC policy group, advocates for the tax-free DEZ where Bitcoin can be traded and accumulated without capital gains taxes but with a tax on redemption.

According to USABTC, the initiative could secure the US’s financial future by fostering a “resilient and innovative” economic environment, leveraging the potential of Bitcoin

BTC $60,870 while maintaining the central role of the dollar.

Strategic approach to BTC

Bitcoin has already challenged policymakers around the world to rethink traditional financial strategies.

The USABTC proposal argues that an outright government purchase of Bitcoin would be both unfeasible and politically untenable.

Therefore, it advocates for the creation of a DEZ, where Bitcoin transactions can be carried out tax-free while incorporating a taxed redemption process to ensure revenue generation.

The initiative says offering tax-free capital gains within this zone could attract investors and foster wealth growth within a regulated environment.

USABTC says the exit tax on Bitcoin conversions back to traditional currency could provide a new revenue stream for the government, which could benefit both the federal and state treasuries.

As a part of the plan, USABTC envisions the creation of a pegged Bitcoin system on a layer-2 solution that would ensure efficient and secure transactions.

Collaboration with regulators

The proposal also outlines a phased approach on how such a DEZ would be implemented in the US, starting with the President issuing an executive directive to authorize the use of the Exchange Stabilization Fund (ESF), a tool within the US Treasury, originally established by the Gold Reserve Act of 1934.

Subsequent phases would involve drafting legal opinions, legislative efforts, and extensive public outreach to ensure broad understanding and support.

The Internal Revenue Service (IRS) would also play a collaborative role in the establishment of a robust legal framework and approving the proposed tax framework.

USABTC says if successful, the implications of this initiative could be a major push toward the US’s position as a leader in the digital economy.

It also explicitly protects against government overreach, a continual concern for many in the cryptocurrency community, by enshrining the right to self-custody into law.

As currently outlined, the implementation phases of USABTC’s plan are slated to begin in 2025. If all legislative and regulatory approvals are secured, the DEZ could be fully operational by 2026.

The US Department of the Treasury and the Internal Revenue Service have moved to enshrine certain tax credits under President Joe Biden’s Inflation Reduction Act (IRA) into the American tax code

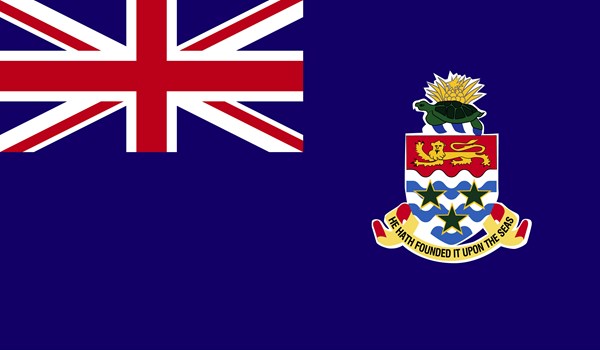

Premier Juliana O’Connor-Connolly presented changes to beneficial ownership legislation to parliament when it met for the last time before the elections. While the Beneficial Ownership Transparency

The fight against corruption has contributed significantly to the on-going transformation of economies across the continent and reinforces the determination towards achieving inclusive and sustainable

Hedge funds piled into long positions on U.S. real estate investment stocks in the week ending Friday, the sixth straight week that these speculators bet on a rebound in commercial and industrial properties,