Main takeaways: On 23 May 2024, the Minister of Finance submitted a draft law No. 8388 with the Luxembourg Parliament (the “Draft Law”) proposing several new tax measures, mainly:

- Amendment and simplification of the minimum net wealth tax regime;

- Clarification that the redemption of an entire class of shares, followed by their cancellation, may be considered as a ‘partial liquidation’ not subject to withholding tax;

- Flexibility for corporate taxpayers to opt out of the dividend exemption regimes provided for by articles 166 and 115, 15a. LITL.

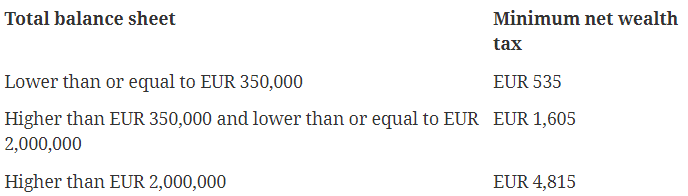

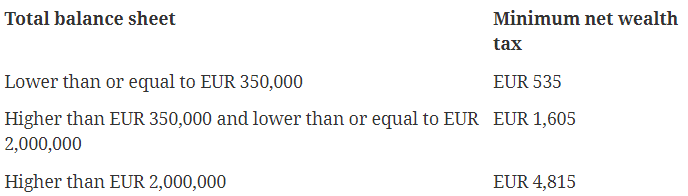

Simplification of the minimum net wealth tax regime

On 10 November 2023, the Constitutional Court had concluded that the minimum net wealth tax regime applicable to companies mainly holding financial assets is contrary to the principle of equality. The Draft Law proposes to introduce a revised and simplified regime where the minimum tax would merely depend on the total balance sheet of the taxpayer.

The new proposed structure is as follows:

Clarification of the tax treatment of share class redemptions

The Draft Law also proposes to clarify the notion of ‘partial liquidation’, which is not subject to withholding tax and typically occurs in case of redemption of an entire shareholding that results in a capital reduction.

In line with Luxembourg case law considering that both the redemption and capital reduction need to occur within a sufficiently narrow timeframe, the Draft Law aim to specify a maximum delay of 6 months between the two operations.

The ‘partial liquidation’ regime would also expressly cover the redemption of a class of shares, followed by their cancellation, subject to the conditions that:

- The redemption covers the entirety of the class of shares;

- The classes of shares were set up at the time of the company’s incorporation or capital increase;

- Each class of shares features different economic rights, defined in the bylaws of the company.

The commentary to the Draft Law refers to examples such as shares giving right to preferred dividends or shares with financial rights linked to the performance of a specific asset or activity;

- The redemption price can be determined based on criteria set out in the bylaws of the company, or in a document referred to in the bylaws of the company, allowing to reflect the fair market value of the class of shares upon its redemption.

If the redemption relates to a class of shares held by an individual who has a significant interest in the company, the company would be required to make a special declaration in its corporate income tax returns. A significant participation is deemed to exist if the shareholder, alone or together with his spouse or partner and minor children, has directly or indirectly held more than 10% of the share capital at any time during the five years preceding the date of the transfer.

Finally, the commentary to the Draft Law emphasizes that the general anti-abuse rule continues to apply.

Opting-out of the participation exemption regime

The Draft Law proposed to allow corporate taxpayers to opt out of two exemption regimes that concern dividends, namely:

- The Luxembourg participation exemption regime provided for by article 166 LITL on dividends received from qualifying participations where the participation held represents at least 10% of the share capital of the subsidiary or has an acquisition price of at least EUR 1,2 million. Due to the constraint imposed by the Parent-Subsidiary Directive, opting-out of the exemption would only be allowed when the exemption is granted (only) by reason of the EUR 1,2 million threshold.

- The partial exemption regime provided for by article 115, 15a. LITL on dividends.

In both cases, the option would need to be exercised each year and on a participation per participation basis.

The introduction of this option is inspired by similar legislation in other EU Member States. It aims to allow more flexibility to taxpayers which may be willing to utilize their tax losses carried forward, in particular where tax losses realized since 1st January 2017 can only be carried forward for 17 years.

Other measures

Other measures of the Draft Law include:

- the mandatory electronic filing as of 1st January 2025 of certain tax declarations such as the withholding tax returns for director’s fees;

- the introduction for 2024 of a new tax credit aiming to compensate certain taxpayers who were negatively impacted upon the expiry of the “crédit d’impôt conjoncture”.